Finance

Revolutionizing finance with incomparable efficiency

The GROW with SAP offering empowers your finance team with a single source of truth about your company’s financial health. Its AI-driven processes help improve forecasting accuracy, shorten reporting cycles, simplify decision-making, and improve risk and compliance management.

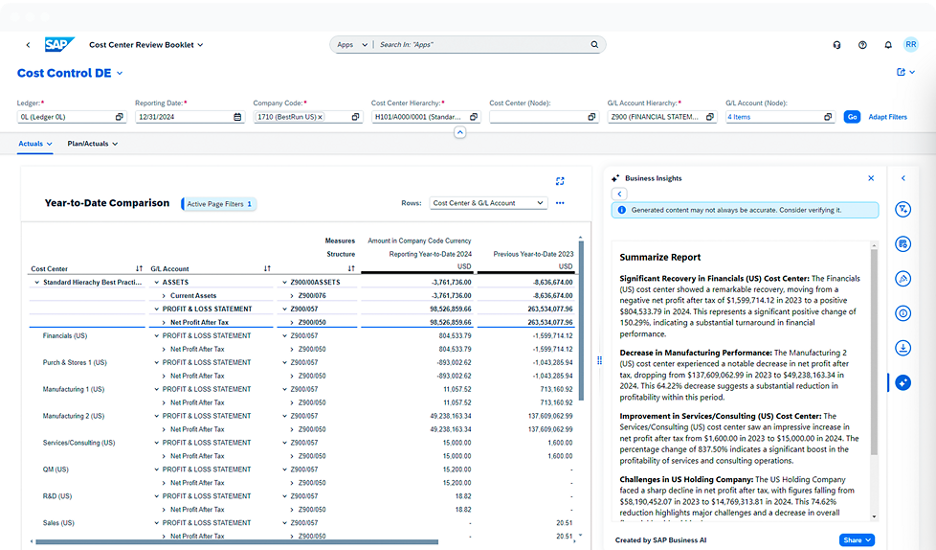

Make the best decisions with real-time data and predictive analytics, supported by generative AI

Shorten reporting cycles and increase productivity with automated, AI-driven finance processes

Improve finance performance by decreasing days sales outstanding, bad debt write-offs, and costs

Grow with confidence and protect business value with embedded risk mitigation and streamlined regulatory and sustainability standards

Gain transparency on cash position and cash forecast, manage cost-effective payments, and mitigate financial risks.

Cloud ERP Essentials

Join our upcoming webinar for expert insights on SAP S/4HANA Cloud Public Edition.

Financial planning and analysis

Capabilities to analyze, plan, budget, forecast, and predict—all in one enterprise planning solution

Holistic and confident financial planning

Deliver timely plans, budgets, forecasts, and reports with greater speed and reliability with a full set of planning features and templates.

Fast and accurate predictions

Automate forecasts at any level of your plans to save time and gain trusted results with the help of AI.

Data-driven decisions

Make informed decisions with analytics enhanced by personalized business insights and recommendations.

Accounting and financial close

Automation that streamlines accounting processes and improves accuracy

Single source of financial truth

Integrate finance data and processes into one source supporting various accounting principles and real-time parallel ledger valuations.

Efficient recording of financial transactions

Increase finance accuracy and efficiency with automatic postings and allocations, situation handling, and flexible workflows.

AI-driven processes

Reduce processing times and improve operations by using AI to enhance account reconciliation processes across goods and invoice receipts.

Unified entity and group close

Use real-time insights and automated processes to improve the governance and compliance of entity and corporate close.

Finance operations

Efficient management of accounts payable and receivable

Optimized accounts receivable

Manage open receivables and resolve disputes faster while controlling credit risk from customers and reducing bad debt.

Accounts payable management

Leverage accounts payable automation to make vendor payments with greater control of cash outflows.

Increased financial health and transparency

Monitor receivables with intuitive analytics, mitigate future disputes, and pinpoint root causes quickly and proactively.

Increased efficiency

Manage operations smoothly with situation handling by automatically notifying and guiding processors of customer invoices at risk of default.

Compliance and tax management

Effective management of regulations through compliance, risk mitigation, and controls

Real-time insights into compliance and risks

Gain real-time insights into the risk of noncompliance, reporting deadlines, and rejections from authorities worldwide.

Automated document exchange and consistency checks

Create and exchange documents automatically, handle corrections smoothly, and verify consistency with authorities' portals.

Simplified and standardized reporting worldwide

Check data quality and remediate issues with full traceability, drill-down access to transactions, and electronic submission.

Treasury management

Optimized working capital and mitigation of financial risks

Cash, liquidity, and working capital management

Manage the bank account lifecycle centrally and monitor cash operations to optimize liquidity and working capital.

Streamlined payments and bank communications

Simplify and centralize internal and external payments with automated workflows and secured bank communication.

Financial risk mitigation

Mitigate financial risk, invest and borrow wisely, and comply with regulations.